Chess has seen a remarkable rise in popularity, reaching a milestone on February 1, 2025, when Chess.com surpassed 200 million members, showcasing its growing global influence. This growing interest in the game has not only fostered a larger competitive community but has also opened doors for chess to create real-world impact, particularly in underserved communities around the globe.

Reach out to discuss this topic in depth.

How chess benefits underserved communities

Chess serves as a compelling case study of how a growing industry can drive social and economic benefits for underserved populations. The game requires minimal resources to play, making it accessible to individuals in even the most disadvantaged regions.

Moreover, its emphasis on strategy, problem-solving, and resilience aligns with skills that are crucial in today’s workforce. As chess expands globally—through online platforms, competitive tournaments, and educational programs—it is creating new career pathways, scholarships, and workforce development opportunities.

Unlike many industries that require substantial infrastructure or investment, chess proves that intellectual capital alone can foster economic mobility. From coaching and streaming to content creation and tournament organization, the growing chess ecosystem is generating employment prospects while simultaneously uplifting disadvantaged communities.

Real-world examples of chess empowering underserved communities

SOM Chess Academy (Uganda)

Founded by Robert Katende, the SOM Chess Academy has introduced chess to at-risk youth, helping them develop critical thinking skills, resilience, and a pathway to economic empowerment. One of its most inspiring success stories is that of Phiona Mutesi, who rose from the slums of Kampala to international recognition through chess.

Mutesi’s journey exemplifies how structured chess training can unlock economic mobility. Through the academy, she gained access to education, scholarships, and global opportunities. Her chess skills not only enabled her to travel the world but also provided her with employment prospects and a platform to inspire future generations.

Chess in Slums Africa

This initiative is dedicated to teaching chess to children in low-income communities, helping them develop cognitive skills and access educational opportunities. Many participants have secured scholarships, proving that chess can serve as a gateway to skill-building, personal development, and social mobility.

The Gift of Chess Initiative

A global movement that distributes chess sets to schools, prisons, and refugee camps, The Gift of Chess fosters education, rehabilitation, and inclusion. By providing access to chess, the initiative empowers individuals to develop strategic thinking, patience, and discipline—skills that translate into broader career opportunities.

FIDE’s “Chess for Freedom” Program

FIDE, the international chess federation, has launched an initiative aimed at teaching chess to inmates and refugees. The program has demonstrated that chess can improve cognitive abilities, provide structure, and offer career-building opportunities for those seeking reintegration into society.

How industries and organizations can get involved

The success of chess in uplifting undeserved communities presents a model that industries and organizations can adopt to drive meaningful talent development. Businesses in digital services, education and workforce training can integrate similar initiatives into their core talent strategies, creating sustainable pathways for skill-building and economic mobility.

Technology sector

Companies in the technology industry can incorporate chess-based training into their workforce development programs. For example, Google and Microsoft have invested in coding boot camps and artificial intelligence (AI) training programs that prioritize problem-solving and computational thinking—skills also cultivated by chess. Integrating chess into digital literacy programs can also further enhance critical thinking abilities for tech-oriented roles.

Education and scholarships

Universities and scholarship foundations can utilize chess-based assessments to identify students with strong cognitive and analytical skills. Programs like the Chess-in-Schools initiative have shown that students who play chess perform better in Science, Technology, Engineering and Mathematics (STEM) subjects, making them ideal candidates for scholarships in science, engineering, and technology fields.

Corporate professional development

Organizations across industries can integrate chess-inspired training into professional development programs to enhance critical workplace skills. Strategic decision-making, analytical thinking, and pattern recognition, which are core competencies in chess, are also essential in leadership, financial analysis, and operational strategy. Companies like Deloitte and McKinsey value structured problem-solving in leadership training, while firms like Renaissance Technologies emphasize strategic forecasting.

By incorporating chess-based exercises into talent development initiatives, industries can build a stronger and more diverse talent pipeline, equipping individuals with transferable skills for digital services, AI training, and other knowledge-based roles. This approach drives both business success and economic inclusion.

Chess, cognitive skills, and the future of tech services

The technology services sector thrives on problem-solving, adaptability, and strategic thinking—all skills that chess cultivates. As businesses increasingly rely on data analytics, AI, cybersecurity, and digital transformation, the ability to recognize patterns, anticipate challenges, and make strategic decisions is more critical than ever.

Chess-based training provides a structured approach to developing these cognitive skills, making individuals more prepared for roles in AI model training, process automation, data annotation, and Information Technology (IT) support.

The same cognitive skills honed through chess can be leveraged to upskill impact sourcing professionals, enabling them to take on more complex, high-value tasks in the tech services industry.

Impact sourcing—hiring and developing individuals from marginalized communities—offers a sustainable and socially responsible approach to workforce expansion while providing businesses with a diverse, resilient, and highly capable talent pool.

Everest Group has committed to significantly expanding the impact sourcing workforce—connecting hundreds of thousands of marginalized individuals to new job opportunities.

Through research, enablement tools, and best practices, as well as engagement with enterprises, service providers, governments, and Non-Governmental Organizations (NGOs), Everest Group is leading the charge in advancing social impact initiatives.

Everest Group’s Clinton Global Initiative (CGI) Pledge

In 2022, Everest Group outlined a Commitment to Action to grow the impact sourcing market from 350,000 full-time equivalents (FTEs) to 500,000 within three years.

Remarkably, this goal was achieved in just two years, fueling a new ambition: to scale the impact sourcing workforce to 1 million by 2030.

This rapid progress highlights the power of innovative approaches to workforce development. Chess is more than just a game—it is a powerful tool for empowerment, a catalyst for social mobility, and a means to break cycles of poverty.

The same strategic thinking, problem-solving, and adaptability that define chess can be applied to upskilling impact sourcing talent, preparing them for knowledge-intensive roles in the digital economy.

By integrating these principles into workforce development, industries can create meaningful economic opportunities, drive long-term social change, and cultivate a more skilled and adaptable workforce.

If you found this blog interesting, check out our Where Sustainability Unites: Climate Week NYC, UNGA, And CGI blog, which delves deeper into another topic regarding impact sourcing and Everest Group’s CGI pledge.

If your organization is interested in joining this initiative or signing the pledge, please reach out to Rita Soni at rita.soni@everestgrp.com, Ankur Verma at ankur.verma@everestgrp.com, or Sidhaant Nagpal at sidhaant.nagpal@everestgrp.com.

]]>

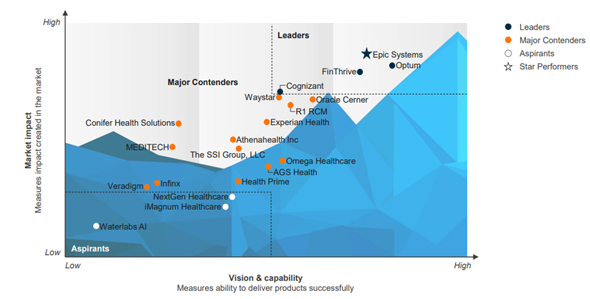

The healthcare outsourcing landscape is evolving rapidly as financial pressures, technological advancements, and regulatory shifts drive payers and providers to rethink their operations. The outsourcing market is far from immune to these trends, and leading service providers are now actively […]]]>

The healthcare outsourcing landscape is evolving rapidly as financial pressures, technological advancements, and regulatory shifts drive payers and providers to rethink their operations. The outsourcing market is far from immune to these trends, and leading service providers are now actively […]]]> Chess has seen a remarkable rise in popularity, reaching a milestone on February 1, 2025, when Chess.com surpassed 200 million members, showcasing its growing global influence. This growing interest in the game has not only fostered a larger competitive community […]]]>

Chess has seen a remarkable rise in popularity, reaching a milestone on February 1, 2025, when Chess.com surpassed 200 million members, showcasing its growing global influence. This growing interest in the game has not only fostered a larger competitive community […]]]> Is Business Process as a Service (BPaaS) the next frontier in healthcare payer outsourcing transformations? 💡 The urgent need for integrated operations for healthcare payers is skyrocketing 🚀, with rising costs 💸 and ever-more complex regulatory requirements 📜 leading to […]]]>

Is Business Process as a Service (BPaaS) the next frontier in healthcare payer outsourcing transformations? 💡 The urgent need for integrated operations for healthcare payers is skyrocketing 🚀, with rising costs 💸 and ever-more complex regulatory requirements 📜 leading to […]]]>

, with rising costs

, with rising costs  and ever-more complex regulatory requirements

and ever-more complex regulatory requirements  leading to a demand for more comprehensive, platform-led solutions. Third-party solution providers have struggled

leading to a demand for more comprehensive, platform-led solutions. Third-party solution providers have struggled  to deliver truly transformational impact with their current workflow and analytics solutions, but BPaaS models can be a game-changer

to deliver truly transformational impact with their current workflow and analytics solutions, but BPaaS models can be a game-changer  , enabling them to drive holistic, scalable, and integrated outcomes for payer organizations.

, enabling them to drive holistic, scalable, and integrated outcomes for payer organizations. , including scalability, cost-effectiveness

, including scalability, cost-effectiveness  , and integrated operations

, and integrated operations  provided by BPaaS solutions, emphasizing how payers can futureproof their operations while seamlessly handling regulatory and other challenges today.

provided by BPaaS solutions, emphasizing how payers can futureproof their operations while seamlessly handling regulatory and other challenges today. , we discussed:

, we discussed:

Payment Integrity VIEW THE FULL REPORT]]>

Payment Integrity VIEW THE FULL REPORT]]> The healthcare payment integrity market is undergoing a significant transformation… In an industry rife with administrative inefficiencies, payment errors, and mounting financial pressures, a recent merger between The Rawlings Group, Apixio’s payment integrity business, and Varis, facilitated by New Mountain […]]]>

The healthcare payment integrity market is undergoing a significant transformation… In an industry rife with administrative inefficiencies, payment errors, and mounting financial pressures, a recent merger between The Rawlings Group, Apixio’s payment integrity business, and Varis, facilitated by New Mountain […]]]>

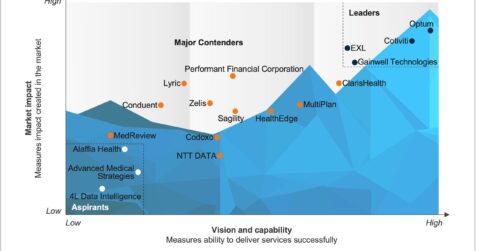

The healthcare payer outsourcing market is rapidly evolving, driven by healthcare payers’ need to enhance efficiency, manage costs, meet member expectations, and navigate complex regulations. As the industry shifts toward member-centricity and robust core administrative processes, an integrated platform and […]]]>

The healthcare payer outsourcing market is rapidly evolving, driven by healthcare payers’ need to enhance efficiency, manage costs, meet member expectations, and navigate complex regulations. As the industry shifts toward member-centricity and robust core administrative processes, an integrated platform and […]]]> Generative AI might be the first disruptor to spring to mind in 2024, but there are other seismic trends at play that are affecting industries worldwide. Fundamental shifts are developing, brought on by the evolving role of captives, changes in […]]]>

Generative AI might be the first disruptor to spring to mind in 2024, but there are other seismic trends at play that are affecting industries worldwide. Fundamental shifts are developing, brought on by the evolving role of captives, changes in […]]]> The Revenue Cycle Management (RCM) sector is undergoing seismic change. With rapid digitization and an evolving future landscape, PE funding and overall M&A activity is dramatically increasing. 🔍 Watch this LinkedIn Live conversation with Everest Group analysts Priya Sahni, Practice […]]]>

The Revenue Cycle Management (RCM) sector is undergoing seismic change. With rapid digitization and an evolving future landscape, PE funding and overall M&A activity is dramatically increasing. 🔍 Watch this LinkedIn Live conversation with Everest Group analysts Priya Sahni, Practice […]]]>

Attendees will get a complimentary copy of Everest Group’s RCM report.

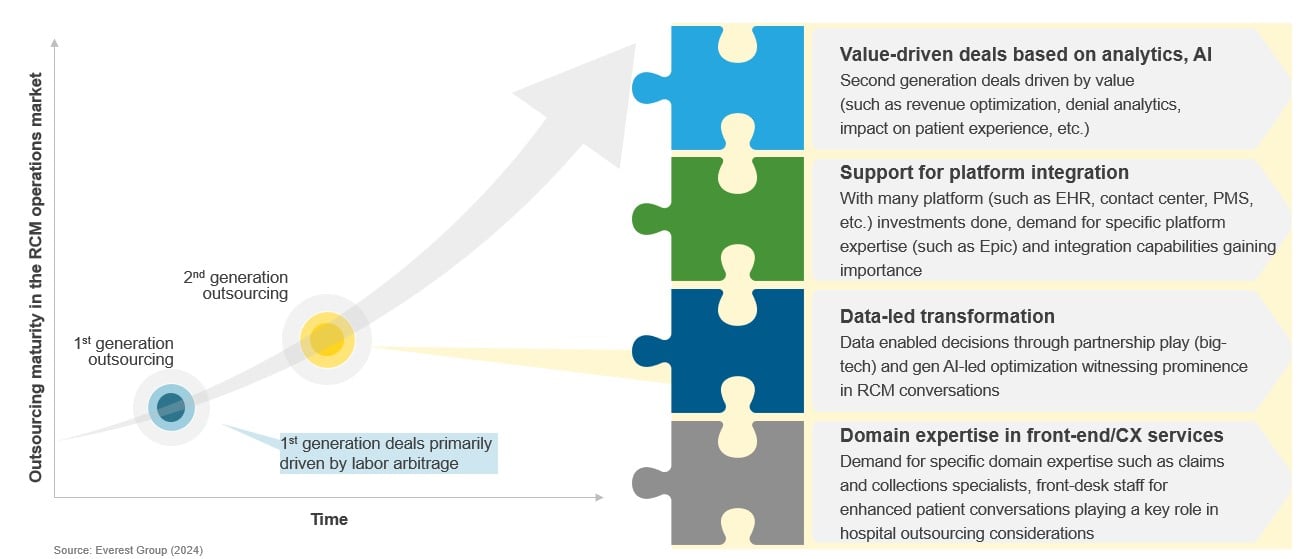

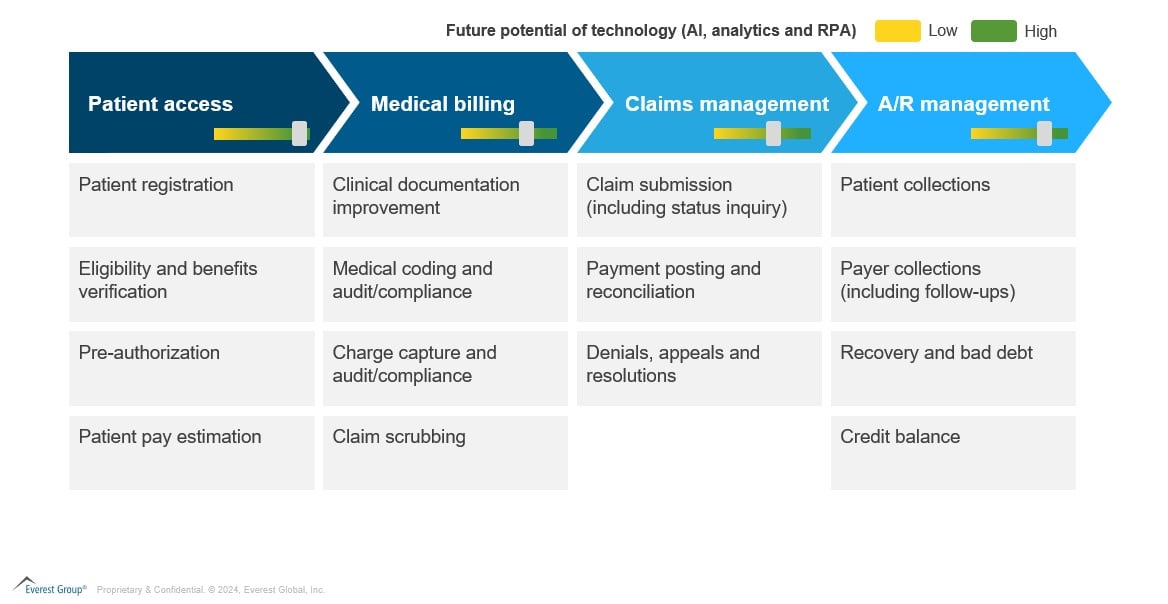

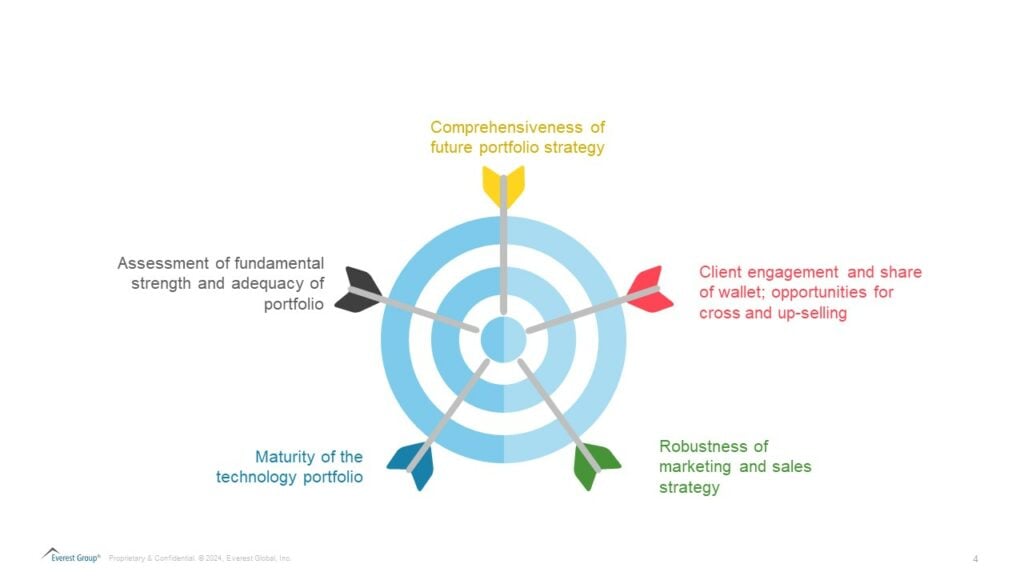

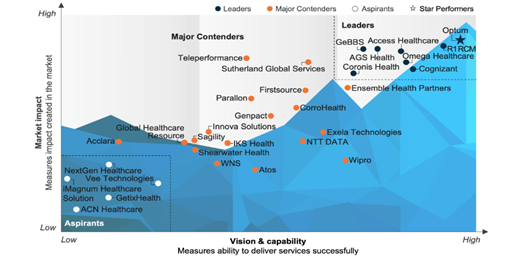

Attendees will get a complimentary copy of Everest Group’s RCM report. Amid healthcare providers’ ongoing struggles with Revenue Cycle Management (RCM) inefficiencies, a new wave of outsourcing is emerging, centered around value and technology-driven solutions like AI and analytics. This surge in demand is propelling significant growth in RCM operations outsourcing, […]]]>

Amid healthcare providers’ ongoing struggles with Revenue Cycle Management (RCM) inefficiencies, a new wave of outsourcing is emerging, centered around value and technology-driven solutions like AI and analytics. This surge in demand is propelling significant growth in RCM operations outsourcing, […]]]>

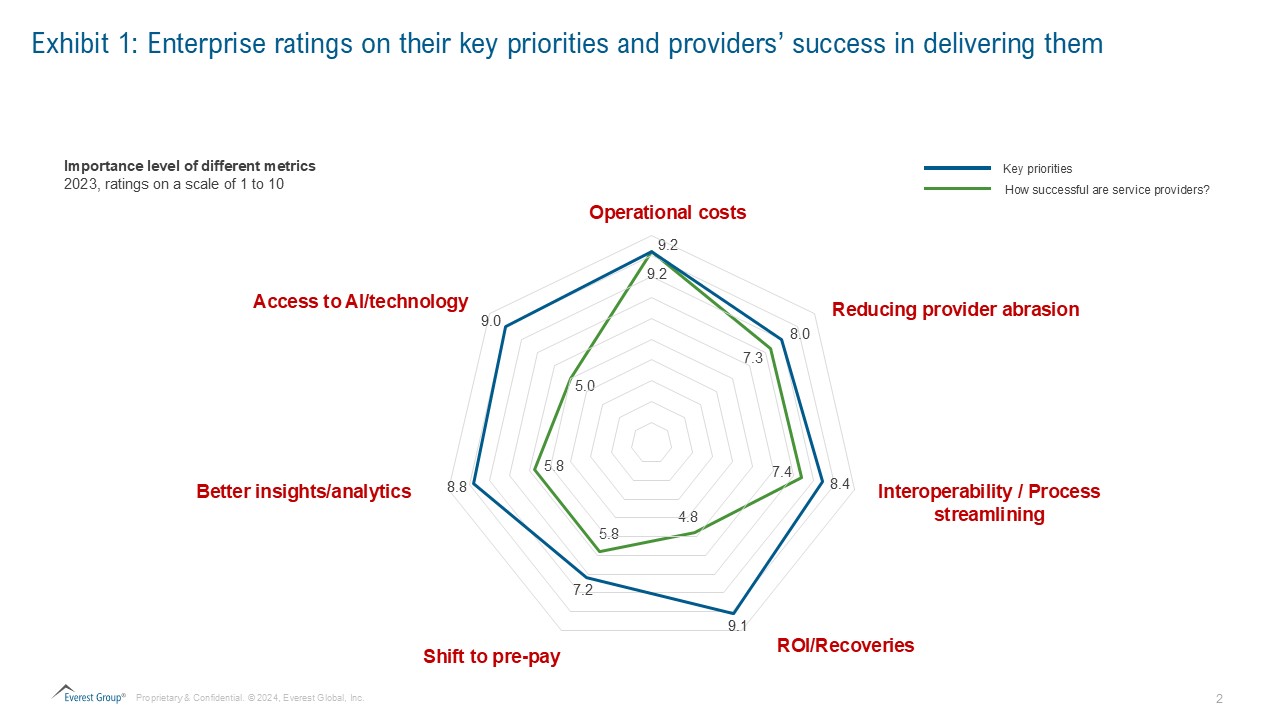

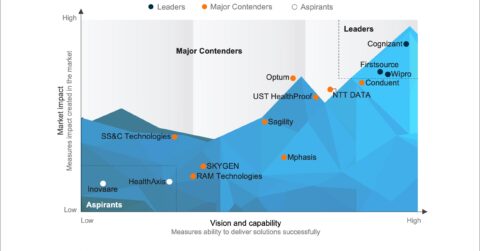

The payment integrity market is dynamically transforming, continuously adapting and enhancing fundamental capabilities within the healthcare industry. The growing emphasis on ensuring accurate and efficient payment processes is creating various opportunities. Key trends gaining prominence include advances in fraud detection […]]]>

The payment integrity market is dynamically transforming, continuously adapting and enhancing fundamental capabilities within the healthcare industry. The growing emphasis on ensuring accurate and efficient payment processes is creating various opportunities. Key trends gaining prominence include advances in fraud detection […]]]>